Fascination About Bankruptcy

Table of ContentsSome Known Questions About Bankruptcy Advice Melbourne.The Only Guide to Bankrupt Melbourne5 Easy Facts About File For Bankruptcy ExplainedBankruptcy Advice Melbourne Can Be Fun For AnyonePersonal Insolvency Fundamentals Explained

As Kibler stated, a firm requires to have a truly good reason to rearrange a great reason to exist and also the rise of e-commerce has made stores with enormous store presences out-of-date. 2nd opportunities may be a cherished American ideal, yet so is innovation and the growing discomforts that feature it.Are you gazing down the barrel of proclaiming on your own bankrupt in Australia? This is no reason for a person leading you down the course of proclaiming bankruptcy.

We comprehend that every person encounters economic stress at some factor in their lives. In Australia, even homes as well as organizations that seem to be growing can experience unexpected hardship due to life modifications, job loss, or elements that are out of our control. That's why, below at Leave Financial Debt Today, we provide you expert guidance and assessments regarding real consequences of bankruptcy, debt agreements and other financial concerns - we desire you to obtain back on your feet and also stay there with the finest possible result for your future as well as all that you desire to acquire.

Liquidation Melbourne for Dummies

It deserves keeping in mind that when it involves financial debt in Australia you are not the only one. Personal bankruptcies and bankruptcies go to a record high in Australia, affecting 3 times as lots of Australian compared to twenty years earlier. There is, nonetheless, no security in numbers when it concerns proclaiming personal bankruptcy as well as insolvency.

One point that lots of Australian people are not aware of is that in real fact you will certainly be detailed on the Australian NPII for merely lodging an application for a financial obligation agreement - Insolvency Melbourne. Lodging a financial obligation arrangement is really an act of declaring on your own bankrupt. This is an official act of personal bankruptcy in the eyes of Australian law also if your financial obligation collectors do not approve it.

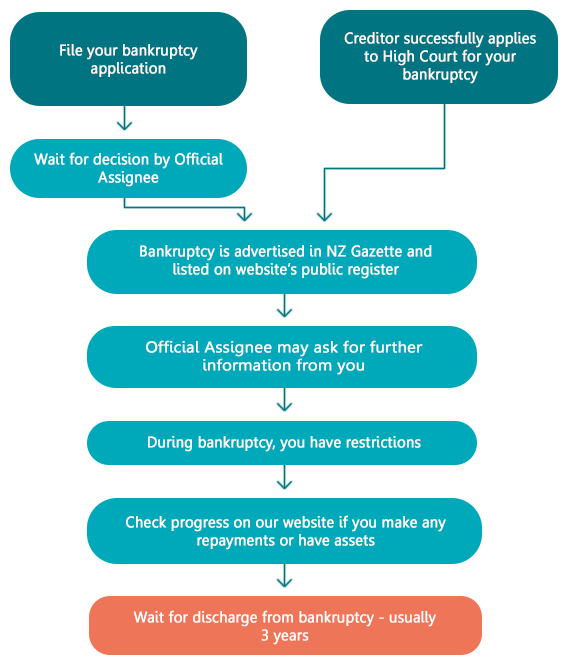

During as well as after your bankruptcy in Australia, you have specific obligations as well as face specific restrictions. Any type of financial institutions who are desiring to obtain a duplicate of your debt report can request this details from a credit reporting firm. Once you are proclaimed bankrupt protected financial institutions, who hold safety and security over your property, will likely be entitled to take the residential property and also market it.

Fascination About Bankruptcy Melbourne

a house or car) When proclaimed bankrupt you have to notify the trustee instantly if you become the recipient of a dead estate If any of your lenders hold valid security over any building as well as they do something about it to recover it, you should aid You must surrender your ticket to the trustee if you are asked to do so You will certainly continue to be liable for financial obligations sustained after the day of your personal bankruptcy You will certainly will not be able to function as a supervisor or manager of a company without the courts authorization As you can see participating in personal bankruptcy can have long-term adverse impacts on your life.

Participating in personal bankruptcy can leave your life in tatters, shedding your residence as well as possessions and leaving you with nothing. Avoid this end result by speaking with a debt counsellor today regarding taking a different thrashing. Insolvency needs to be appropriately believed about as well as planned, you must never enter bankruptcy on a whim as it can take on you that you might not even know. Bankrupt Melbourne.

We offer you the ability to pay your financial obligation off at a lowered price as well as with minimized interest. We Resources know what lenders are looking for as well as are able to work out with them to provide you the most effective possibility to pay off your debts.

Rumored Buzz on Insolvency Melbourne

What is the distinction between default and bankruptcy? Back-pedaling a loan means that you've violated the promissory or cardholder arrangement with the lending institution you could try here to pay promptly. Each lending institution has its very own demands surrounding how numerous missed out on settlements you can have prior to it considers you in default. In some situations, that may be as little as one missed out on settlement or it can be as lots of as 9 missed payments.

File For Bankruptcy Things To Know Before You Buy

As an example, if you back-pedal a vehicle car loan, the lender will certainly usually attempt to retrieve the vehicle. Unprotected debt, like credit report card debt, has no security; in these instances, it's more difficult for a collection firm to recoup the financial debt, but the company might still take you to court and attempt to position a lien on your home or garnish your salaries.

The court will designate a trustee who may liquidate or sell some of your ownerships to pay your financial institutions. While a lot of your financial debt will certainly be terminated, you might choose to pay some lenders in order to look at these guys keep an auto or residence on which the financial institution has a lien, claims Ross (Insolvency Melbourne).

If you work in an industry where companies inspect your credit score as part of the working with procedure, it might be more difficult to get a brand-new work or be promoted after insolvency. Jay Fleischman of Money Wise Law claims that if you have charge card, they will often be shut as quickly as you declare bankruptcy.